Frank J. Cassisi, lawyer allegedly filed forged documents in multiple courts. Photo: Facebook

By Milton Allimadi

Queens resident Ashmeen Modikhan hopes that a court hearing on June 12, 2025 before Judge Maurice Muir in New York State Supreme Court in Queens County will begin to unravel what she claims is an alleged scheme by her former attorney Frank Cassisi to “steal” her $5 million personal injury lawsuit.

Ms. Modikhan has also been waging battle in U.S. Bankruptcy court, in the Eastern District of New York, over alleged illegal foreclosures on her two real properties that were initiated in the State court in 2010 and 2012, respectively. The personal injury case is now entangled with the bankruptcy case as will be shown below.

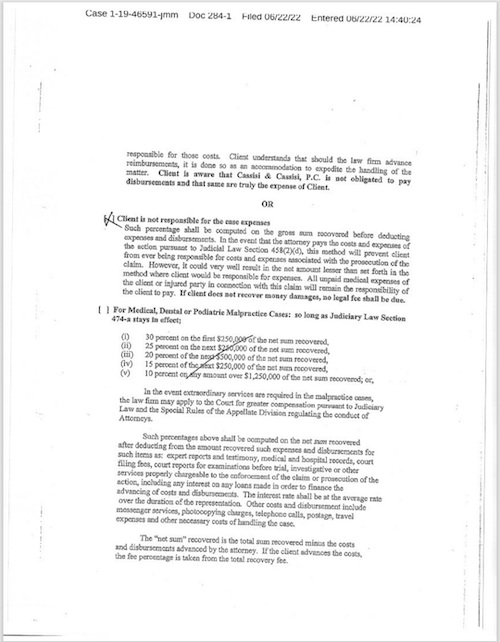

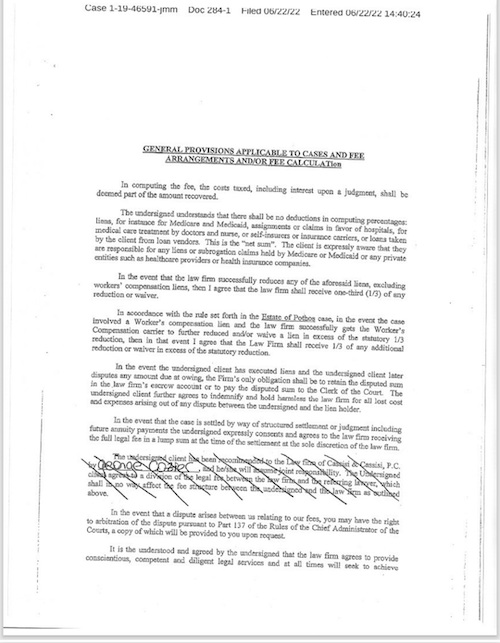

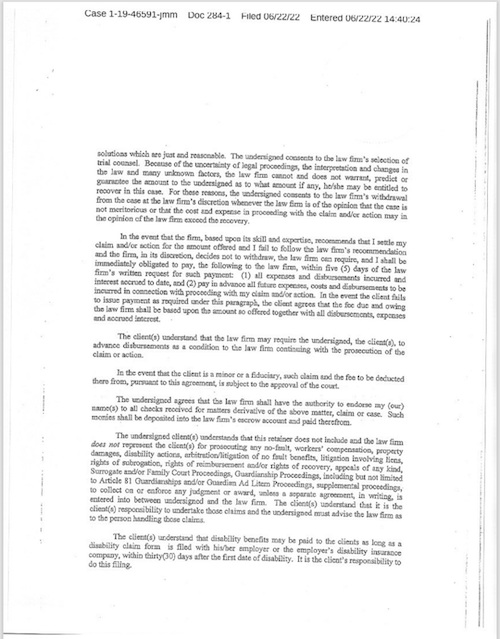

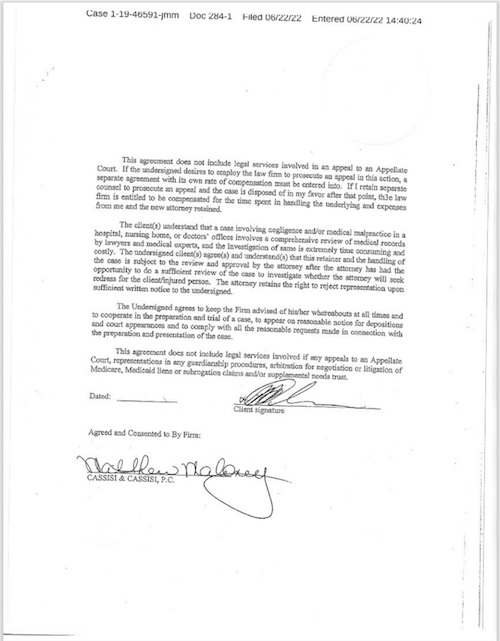

The alleged Cassisi forged retainer agreement which has no date and has a signature that doesn’t match Maloney’s in other documents. Bankruptcy Judge Mazer-Marino shrugged it off. Ms. Modikhan hopes the DOJ and FBI will investigate the matter.

Cassisi represented Ms. Modikhan when she sued Golden Touch Transportation of New York Inc., a contractor for her former employer American Airlines, in 2015. The previous year, the door of a bus operated by Golden Touch to ferry airline employees from terminals to parking lots closed prematurely, crushing Ms. Modikhan’s right hand and shoulder. She sustained career-ending nerve damages that affected her hand, arm, and lower back.

Meanwhile, Ms. Modikhan’s alleged illegal foreclosure cases reached the bankruptcy court in 2019, where she was also the victim of an alleged loan modification scheme, previously covered by Black Star News. She wasn’t aware that earlier that same year, Darren Aronow, the lawyer who represented her in the bankruptcy court had signed a consent oder with the state of Maryland for taking money from homeowners and never delivering on loan modification he’d promised them. Aronow refunded consumers $122,661.50 and paid $10,000 in penalty to the state and $2,170 in investigative fees. The law prohibits attorney fees during the loan modification process which is what he was sanctioned for. He did the same to Modikhan but the presiding Judge Jil Mazer-Marino let him off the hook with no sanctions.

Mazer-Marino also whitewashed Ms. Modikhan’s fraud allegations for several filed false and fraudulent proofs of claim (POCs) that were subsequently wrongfully recognized by the judge as secured creditors against Ms. Modikhan’s estate. Judge Mazer-Marino went on to lift the stay on the sale of Ms. Modikhan’s two properties.

(In addition to the fraudulent POCs, the cases should have been thrown out in the State court when they were initiated in 2010 and 2012, respectively, since the plaintiffs did not possess both the promissory note and mortgage as required by law, Ms. Modikhan claims. The 2010 case was initially dismissed because the court recognized the plaintiff didn’t comply with the law, but it was allegedly fraudulently restored to the calendar. If the foreclosure claim was illegal from the getgo in State court how could they have become legitimate while Mazer-Marino was the presiding judge? This matter will be the subject of the next article).

The bankruptcy court chapter 7 trustee, Alan Nisselson, was then allowed by Judge Mazer-Marino to hire Cassisi away from Modikhan since Nisselson was now administering her estate, which included the $5 million personal injury lawsuit.

It was at that point that things began to unravel.

As part of the process to begin work with his new boss Nisselson, the lawyer Cassisi filed a purported retainer agreement he’d executed with Modikhan on the docket in the bankruptcy court on June 22, 2022.

Upon review, this reporter discovered that Cassisi had filed what appeared to be a forged document, as explained below:

(A) The purported “retainer agreement” has no date; (B) a paragraph describing how George Crozier, a former American Airlines co-worker who introduced Ms. Modikhan to Cassisi would be compensated, is crossed out and not initialed, and; (C) there’s a signature attributed to Matthew Maloney, who was an associate at Cassisi’s firm, that does not match Maloney’s signature on the version of the retainer agreement in Ms. Modikhan’s possession, which is dated, April 16, 2015.

In the version of the retainer agreement in Ms. Modikhan’s possession, the paragraph describing how Crozier would be compensated remains intact.

Having raised suspicion with his filing of the forged document in the bankruptcy, I decided to review documents filed by Cassisi in the State Court.

There, Cassisi’s firm filed a “Request for Judicial Intervention” on December 24, 2015. The document was purportedly signed by Maloney. The Cassisi firm also filed an “Affirmation of Good Faith,” also dated December 24, 2015, with a signature attributed to Maloney. The signature on this document doesn’t match the purported Maloney signature on the “Request for Judicial Intervention” filed on the same date. It also does not match the Maloney signature on the purported retainer agreement Cassisi filed in the bankruptcy court on June 22, 2022, or the signature in the version of the retainer in Ms. Modikhan’s possession.

None of the signatures attributed to Maloney–including the undated one filed by Cassisi in the bankruptcy court–match.

In any event, Maloney could not have signed any of the documents discussed above since his registration to work for the Cassisi firm wasn’t processed until Sept. 9, 2016, according to a letter from Samuel H. Younger, the chief management analyst for the Office of Court Administration, Attorney Registration Unit.

Judge Mazer-Marino refused to refer for criminal investigation the filing of the document by Cassisi in the bankruptcy court during a court session attended by this reporter. Instead, the judge offered her a url address for her to file a complaint.

Ms. Modikhan believes Judge Mazer-Marino won’t deal with the alleged Cassisi forgery because then she’d also have to address her allegations about the filing of fraudulent proofs of claim.

Ms. Modikhan has copied documents she’s filed in the bankruptcy court about the Cassisi’s documents to the U.S. Attorney General, Pam Bondi, and the FBI Director Kash Patel. She hopes the matter will be investigated.

Ms. Modikhan has also appealed what she alleges were unlawful sales of her properties, citing fraud and lack of proper court approval.

In addition to approving the hiring of Cassisi by Nisselson—notwithstanding the undated retainer agreement—Judge Mazer-Marino also approved a $500,000 settlement of Ms. Modikhan’s $5 million lawsuit by Nisselson and Cassisi. In court documents Nisselson and Cassisi have implied that the settlement was sometime in June of 2022. Judge Mazer-Marino also approved Cassisi’s 33 1/3 cut for legal fees, meaning he was paid $166,666,666 even after filing the undated document in the bankruptcy court.

Ms. Modikhan believes that Cassisi may have actually settled the case several years ago, shortly after filing it in 2015 on her behalf, and that he just never told her about it. No documents have been produced related to the purported settlement negotiated by Nisselson and Cassisi. Meanwhile, the bankruptcy court denied Ms. Modikhan’s motion to compel the production of the settlement documents. U.S. District Court Judge Eric R. Komitee also denied her appeal without even mentioning the Cassisi forged documents. Ms. Modikhan plans to file an appeal with the Second Circuit Court of Appeals. “They are not producing the documents because there is no legitimate settlement,” Modikhan has said.

Ms. Modikhan maintains any purported settlement—whether Cassisi settled the case years ago and never told her, or whether he and Nisselson settled with Golden Touch in June 2022—is null and void.

To begin with, Cassisi never executed a retainer with Ms. Modikhan, she argues. Which also means the trustee Nisselson could not have hired Cassisi as special counsel since there was no attorney/client relationship between the debtor and the attorney.

Cassisi also did not file for substitution of Nisselson as the plaintiff in the personal injury case, until Sept. 2, 2022, and Judge Maurice Muir, who is presiding over the case, did not grant the motion until April 3, 2024. So how could have Nisselson and Cassisi “settled” the case in June 2022, fully 21 months earlier, when Ms. Modikhan was still the plaintiff?

Ms. Modikhan has appealed the substitution of Nisselson as the plaintiff. She filed her brief on Feb. 10, 2025 in the second judicial department. The trustee has not filed a response but on May 3, 2025 a lawyer named Jack Lockwood with Pollock Pollock Isaac, filed a motion on behalf of Nisselson seeking to dismiss the appeal.

Modikhan wants to be restored on the caption of her personal injury case and to have a jury trial.

She says she should be allowed to deal with the illegal foreclosure separately and that a federal investigation into the fraud would untangle that and restore her properties to her. “In any case, since Mazer-Marino allowed my homes to be improper sold and the non-existent creditors were satisfied why are they still trying to take away my $5 million personal injury lawsuit?” she said.

Cassisi has also tried to pull the rug from under Ms. Modikhan’s feet before her appeal can be heard. On March 3, 2025 he and a lawyer named Daniel Wang, who’s with Lewis, Brisbois, Bisgard & Smith, LLP, the firm representing Golden Touch, filed a stipulation dated Feb. 28, 2025 asking Judge Muir to discontinue the personal injury case since the matter has been “settled.”

This would moot Ms. Modikhan’s appeal.

Ms. Modikhan has filed papers objecting to the discontinuance sought by Nisselson and Wang.

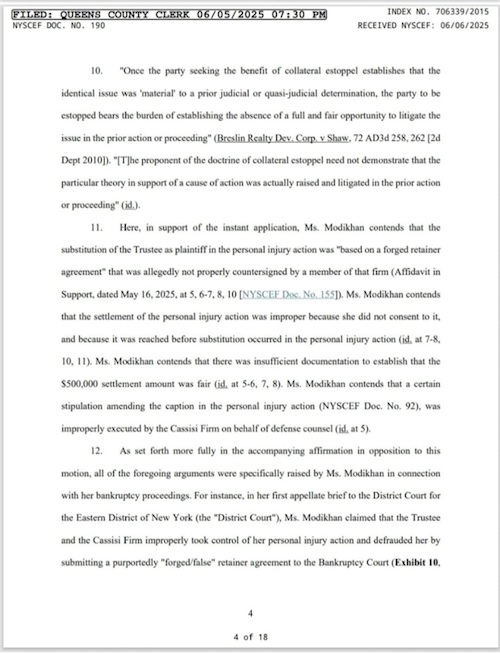

In a June 5, 2025 memorandum of law in opposition to Ms. Modikhan’s motion to set aside the stipulation of discontinuance, Lockwood, the lawyer, on behalf of trustee Nisselson, claimed Ms. Modikhan is trying to re-litigate issues that have already been decided upon in the bankruptcy court and that the principle of res judicata must apply.

With respect to Ms. Modikhan’s allegations about the alleged Cassisi forgery, Nisselson, in creative language, states, “Here, in support of the instant application, Ms. Modikhan contends that the substitution of the Trustee as plaintiff in the personal injury action was ‘based on a forged retainer agreement’ that was allegedly not properly countersigned by a member of that firm,” referring to Cassisi’s law firm.

This is of course not what Ms. Modikhan claims. She has alleged that the signature on the purported “retainer agreement” attributed to Matthew Maloney, the former associate at the Cassisi firm, was forged, as explained above. This is a far cry from “allegedly not properly countersigned by a member of that firm,” as Nisselson claims in his court papers.

In court papers lawyer for Nisselson refers to the alleged Cassisi forgery as a document “allegedly not properly countersigned by a member of that firm…”

Lockwood did not respond to an e-mail seeking comment.

Separately, William Jorgenson, Assistant District Attorney and Chief, Housing and Worker Protection Bureau, in the Queens County District Attorney’s Office did not respond to an e-mail message sent on May 14, 2025 with questions about the filing of the alleged forged documents by Cassisi in the State court.

Black Star News sent questions about the Cassisi filings in the State court to Judge Muir via e-mail message. The questions were also copied to Judge Joseph A. Zayas, Chief Administrative Judge and Judge Marguerite A. Grays, Queens County Administrative Judge.

There has been no response.