Ms. Bobrowsky alleges she’s victim of wrongful foreclosure attempt, including with use of forged documents.

By Milton G. Allimadi

Shereen Bobrowsky, the disabled Yonkers woman, a senior, who claims there’s an ongoing attempt to wrongfully foreclose on her property-and to harass and intimidate her-wants to know why Judge Paul I. Marx, who’s presiding over the case hasn’t sanctioned the opposing party for violating deadlines set by the court for delivery of documents.

Separately, after reviewing some of the documents that are on the docket in the State Supreme Court, Westchester County, White Plains, New York, in light of past reports about compromised records in various court jurisdictions, in New York and elsewhere, this reporter is curious as to why there were no decisions and orders of the many motions Ms. Bobrowsky entered that requested important items such as “the accounting” and the Pooling and Servicing Agreement (PSA).

Ms. Bobrowsky, who is in her 70s, also believes a campaign to intimidate her has escalated and now become dangerous. Recently, after a short drive from her home, she realized she had a flat front tire. When she got out to inspect the flat, she discovered that a nail had been stuck into the tire.

“It’s one thing to send someone to snoop around my property or to steal my garbage,” Ms. Bobrowsky says, describing past incidents. “But to start puncturing my tire, knowing that I have to drive down a steep slope as soon as I leave my property, that’s something else,” she says.

Ms. Bobrowsky was sued by US Bank Trust National Association, Not In Its Individual Capacity But Solely As Owner Trustee for REO Trust 2017-RPL1, in the New York State Supreme Court, Westchester County, White Plains, New York.

This is a second article covering her ordeal, which she says keeps her awake at night and leaves her sick with a migraine headache, sometimes for days.

Ms. Bobrowsky says she has not missed a single mortgage payment since January 2003, and she has her records as proof. Yet, she is facing what she calls a third “wrongful, fraudulent, and illegal foreclosure” lawsuit. The first two-one in 2016 and the second in 2020-were both voluntarily discontinued by the bank, for no reason except to stall, causing her harm, Ms. Bobrowsky says. “In December, governor Hochul signed a bill into law called the foreclosure abuse prevention act that’s meant to prevent the type of abuse I’m enduring,” she says.

Ms. Bobrowsky previously complained of harassment by a man who comes to her home monthly to “inspect” the property, purportedly for the mortgage servicer (Nationstar dba Mr. Cooper), who Ms. Bobrowsky believes is behind the three lawsuits based on the same allegations. The man, whose identity she does not know, has taken her picture occasionally and one time even peered into her home from the window, she says.

Max Saglimbeni, an associate with Knuckles Komosinki & Manfro, LLP., the firm representing the plaintiff, didn’t respond to an earlier e-mail message from this reporter asking him if the unidentified man works for his client. Ms. Bobrowsky said the man has not shown up since the first article.

Also, Mr. Saglimbeni’s firm billed Ms. Bobrowsky $30,000 in legal fees for the work that they say they’ve done for their client, the plaintiff. Mr. Saglimbeni didn’t respond to an earlier e-mail message inquiring about the bill and whether Judge Marx was aware of it.

Then recently, on two separate occasions, Ms. Bobrowsky’s green garbage bags disappeared. She suspects whoever stole them is fishing for evidence and she filed a police report after the first incident. “Now I put my dog’s pooh-pooh on top of the bag,” she says.

However, the tire incident suggests that whomever is trying to intimidate her is getting desperate, Ms. Bobrowsky says. One recent morning, accompanied by her 85-year-old cousin, the two were driving downhill to head to the farmers’ market when she realized she had a flat. After discovering the nail, she took her vehicle to a nearby repair shop.

Ms. Bobrowsky is confident justice will prevail if the court goes by the evidence alone. Yet, she’s troubled, she says, by the fact that Judge Marx didn’t sanction the plaintiff, through Saglimbeni, after they failed to deliver to her all the documents by the deadline as instructed by the court.

At an Aug. 21, 2024 hearing covered by our reporter Colin Benjamin, Judge Marx had directed Saglimbeni to produce the following documents to Ms. Bobrowsky by Sept. 30, 2024: her complete payment history; a copy of the promissory note and of all assignments and the attached allonges; a copy of the mortgage; a copy of all default notices, including the 90 day notice prior to initiating foreclosure as required by New York law; a copy of the affidavit of service, and; any documents that Saglimbeni intended to use for the summary judgment motion he told the judge that he intended to file.

The Sept. 30 deadline came and went, and the plaintiff hadn’t produced all the documents as directed by Judge Marx, including the critical complete payment history, and the promissory note and all assignments and the attached allonges, Ms. Bobrowsky says.

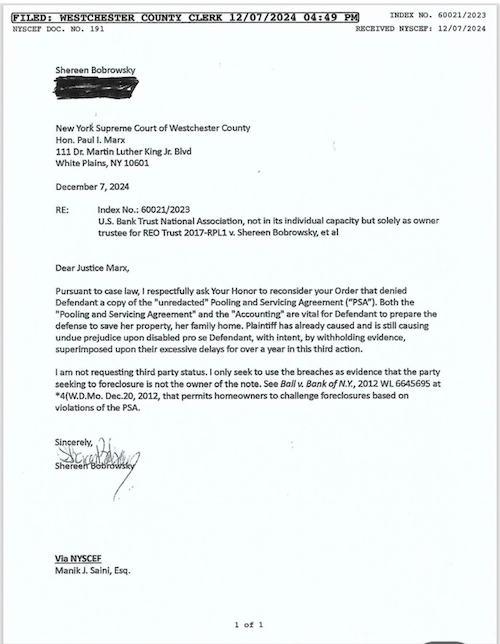

Yet, the court still allowed Saglimbeni to file a summary judgment motion which Ms. Bobrowsky was required to respond to-and did-by Dec. 20. “I’m the only one who’s supposed to play by the rules?” Ms. Bobrowsky says. “I’m also very concerned that the court has not provided any written decision and orders on my motions requesting the vital accounting, as well as the pooling and servicing agreement. This deprives me of my right to appeal.”

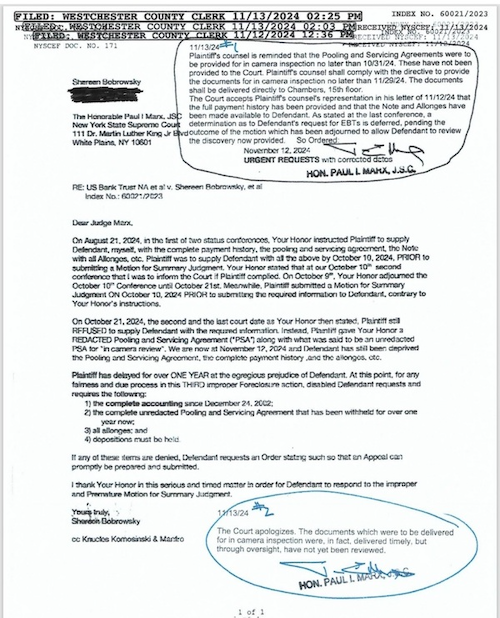

Ms. Bobrowsky also noticed what she called two “strange” orders on the court docket. The purported orders are attributed to Judge Marx. One is stamped on the upper right corner of a letter that Ms. Bobrowsky submitted to the court, and; the second one is stamped on the lower right hand of the letter. The first order, bearing a signature attributed to Judge Marx, stated, in part, “…the court accept’s plaintiff’s counsel’s representation in his letter dated 11/12/24 that the full payment history has been provided and that the Note and Allonges have been made available to the defendant…”

Judge Marx didn’t respond to questions about these purported “orders.”

“This is nonsense. Why would I be requesting for the full payment history if they were provided,” Ms. Bobrowsky says. “Just like I said last time, I may be old and appear slow at times, but I’m no fool. I wonder how many other vulnerable homeowners are treated this way.”

“Instead of taking plaintiff’s word, ex parte, that plaintiff complied, Judge Marx should hold a hearing so both sides can be questioned and have the plaintiff produce the documents in open court,” Ms. Bobrowsky says. “I am being egregiously prejudiced by the withholding of documents with no sanctions against plaintiff. I have been requesting various documents for over one year now to no avail while discovery and depositions are also being withheld.”

“I demand sanctions for plaintiff’s failing to disclose the documents I have been requesting for over a year. But I also request the court to allow for full discovery for which I am entitled. I initially had an attorney but the court allowed him to be relieved as counsel over my objections. Now, all my requests seem to be for naught in this third foreclosure action that is based on clear fraud,” Ms. Bobrowsky adds.

The second order, on the lower right portion of Ms. Bobrowsky’s letter, also bearing a signature attributed to Judge Marx, stated: “The court apologizes. The documents which were to be delivered for in camera inspection, were in fact, delivered, timely, but through oversight, have not yet been reviewed.”

This was in reference to the un-redacted Pooling and Servicing Agreement (PSA), which Ms. Bobrowsky has been denied a copy. The version Saglimbeni sent her is so redacted that it’s illegible, she says. Ms. Bobrowsky was informed previously that the court also hadn’t received an un-redacted copy; yet the purported order attributed to Judge Marx claimed a copy was indeed submitted.

Ms. Bobrowsky says she’s entitled to an unredacted PSA that she can actually read.

“By saying I’m not entitled to an un-redacted Pooling and Servicing Agreement is akin to saying I’m not entitled to a defense. Plaintiff, and the court, are also refusing to supply the name of the Pooling and Servicing Agreement, which is on the SEC website, but cannot be looked up without a name,” Ms. Bobrowsky says.

A second document that Ms. Bobrowsky discovered on the docket, a “Court Notice,” dated Nov. 13, 2024 stated in part: “The court has reviewed the Pooling And Servicing Agreement (“the Agreement”) which was submitted by Plaintiff’s counsel, as directed. Defendant’s request for an unredacted for an unredacted copy of the agreement is denied.” Ms. Bobrowsky states that since this was not a decision and order but merely a Court Notice, she cannot appeal the denial.

“I don’t know whom and what to believe anymore,” Ms. Bobrowsky says.

Judge Marx did not respond to an e-mail message seeking confirmation that the purported ex parte orders were authentic and that the two signatures belong to him. The judge also didn’t respond to a question seeking confirmation that he did in fact receive and review an un-redacted copy the PSA, and a question as to why Ms. Bobrowsky can’t be provided with a copy.

The questions sent to Judge Marx were also copied to New York State Attorney General, Letitia James, Yonkers Police Commissioner, Christopher Sapienza, the plaintiff’s lawyer Saglimbeni, and Judge Anne E. Minihan, the District Administrative Judge.

“Your e-mail is received,” Judge Minihan’s office responded, confirming receipt of the copied questions.

As reported in the earlier article, the plaintiff also failed to provide the complete payments history when directed on Dec. 21, 2023, to be supplied within three weeks to do so by court attorney referee, Sheila Gabay, when the matter was in settlement conference, Ms. Bobrowsky says.

Ms. Bobrowsky previously alleged that the signature attributed to Ms. Theresa Barrett, as the person who signed and notarized that she witnessed Ms. Tamara Sulea execute an assignment of mortgage on September 6, 2019 is “a forgery”-an allegation which has since been confirmed by the authorities in Los Angeles, Ca., where Ms. Barrett’s notary oath is kept, Ms. Bobrowsky says.

What’s more, Ms. Bobrowsky claims, the purported assignment of mortgage filed in the Westchester County Clerk’s office is also fraudulent. The document states that it was executed on Nov. 6, 2019, which is two months after Notary Public Ms. Barnett’s signature-the same signature Ms. Bobrowsky claims was forged.

Mr. Saglimbeni also didn’t respond to questions about this allegation. “I’m perplexed as to why the Westchester County Clerk Timothy Idoni has not referred the filing of a false instrument for investigation by the District Attorney or the Attorney General,” Ms. Bobrowsky says. “When a fraud is brought to the head of the county clerk, they have a duty to maintain the laws in its government entity. Filing a false document is a misdemeanor, but when it affects a deed, it is a felony.”

If you’ve been the victim of an illegal or wrongful foreclosure and have documentation please reach the reporter at [email protected]